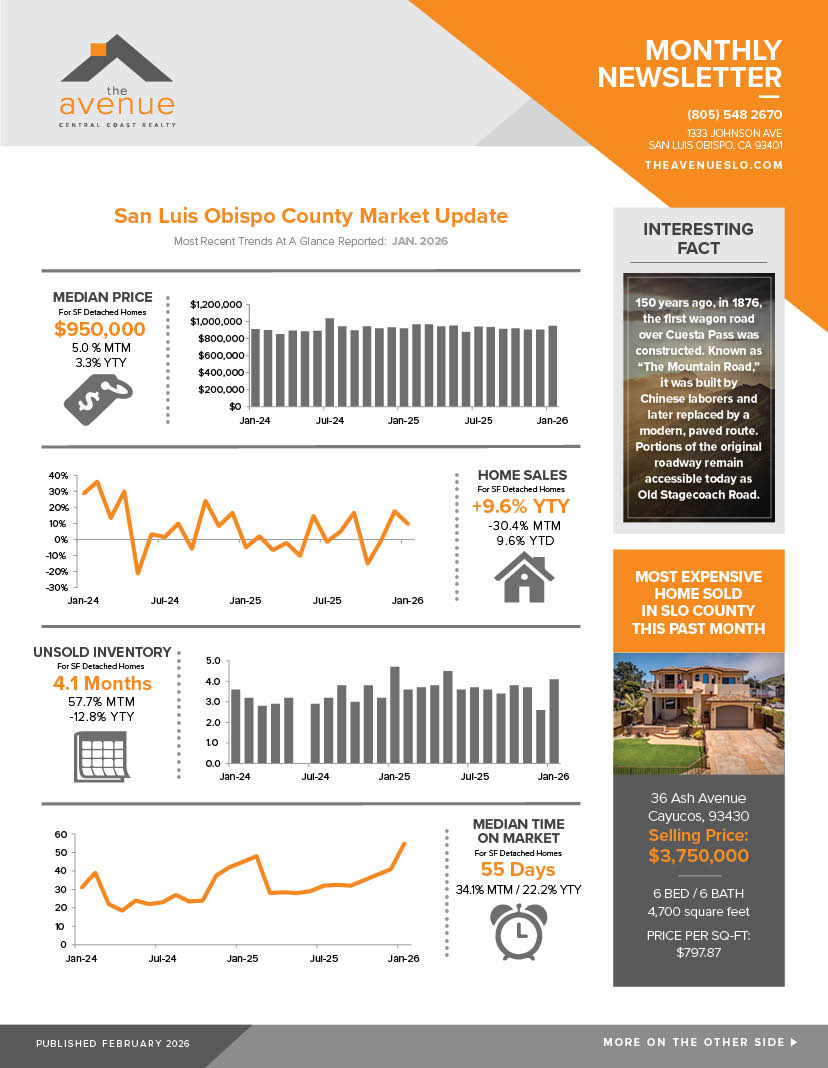

SLO County Market Update & Article on TAX TIME

*INTERESTING FACT –

150 years ago, in 1876, the first wagon road over Cuesta Pass was constructed. Known as “The Mountain Road,” it was built by Chinese laborers and later replaced by a modern, paved route. Portions of the original roadway remain accessible today as Old Stagecoach Road.

TAX TIME

On July 4, 2025, legislation dubbed the “One Big Beautiful Bill” was signed into law. The sweeping measure both preserves and reshapes existing tax policy, making permanent several provisions that were originally enacted on a temporary basis under the 2017 Tax Cuts and Jobs Act (TCJA). Below, we outline the key 2025 tax updates and highlight how they may affect your return.

Standard Deduction Increase

For 2025, the standard deduction is $31,500 for married couples filing jointly, $15,750 for singles and married individuals filing separately, and $23,625 for heads of household. There will be an annual $750 increase, adjusted for inflation, each year thereafter.(In 2026, it rises to $32,200, $16,100, and $24,150, respectively.)

Salt Deduction

The SALT (state and local tax) deduction lets itemizing taxpayers subtract state and local income, sales, or property taxes from their federal taxable income — though you can only choose

either income or sales taxes, not both. Designed to prevent double taxation, it ensures you aren’t taxed federally on income already taxed by your state or city. In 2025, the SALT deduction cap increased from $10,000 to $40,000 for most filers ($20,000 for married couples filing separately).

No Tax on Tips

If you earn tips, you may deduct up to $25,000 of qualified tips on your federal taxes, though the deduction phases out for incomes over $150,000 ($300,000 for joint filers). It doesn’t fully eliminate taxes — federal and payroll taxes still apply, and your state may tax tips too. This deduction is temporary, valid only for the 2025–2028 tax years.

No Tax on Overtime

Taxpayers can deduct up to $12,500 ($25,000 for joint filers) of qualified overtime pay (the extra pay above a regular rate, usually the “half” portion of time-and-a-half required by the Fair Labor Standards Act). The deduction is available to both itemizing and non-itemizing taxpayers and phases out for those with MAGI (modified adjusted gross income) over $150k ($300k if filing jointly).

Seniors 65+

For 2025–2028, seniors 65 and older can claim an extra $6,000 deduction on top of their standard or itemized deductions ($2,000 for single seniors, $1,600 per individual for married seniors filing jointly), which can significantly reduce or even eliminate federal tax on Social Security benefits. The deduction phases out for higher-income taxpayers — $75,000–$175,000 for singles and $150,000–$250,000 for joint filers — reducing by six cents for every dollar over the threshold. To qualify, you must be 65 or older by the end of the year and not file as Married Filing Separately.

Electric Vehicles & EV Equipment Credits

The federal $7,500 tax credit for new electric vehicles and $4,000 for used EVs has completely expired for vehicles acquired after September 30, 2025. However, the EV charging equipment credit will remain available on purchases made before June 30, 2026. Individuals can claim 30% of the cost of hardware and installation, capped at $1,000/unit. Businesses may claim up to $100,000/unit.

Car Loan Interest Deduction

For 2025–2028, you can deduct up to $10,000 in interest on loans for new, U.S.-assembled cars, vans, SUVs, or motorcycles (under 14,000 lbs) bought after Dec. 31, 2024. The deduction phases out for MAGI over $100,000 ($200,000 filed jointly). The loan must be secured by the vehicle, which must be purchased (not leased) to encourage American-made vehicle sales.

Increased Child Tax Credit

The 2025 Child Tax Credit jumps to $2,200 per child under 17. Single filers earning up to $200K and married couples up to $400K get the full credit, which phases out above those limits. Going forward, the credit will be adjusted annually for inflation.

529 & 530A Savings Accounts

For 529 accounts, starting January 1, 2026, the annual tax-free K–12 tuition withdrawal doubles from $10,000 to $20,000. From July 5, 2025, qualified expenses expand to include books, tutoring, educational therapies, homeschool curriculum, test fees, dual-enrollment, and career training (certificates, licenses, apprenticeships). Up to $35k of unused funds can roll over to a Roth IRA, with generous gift tax exclusions, enhancing flexibility for private school, homeschooling, and higher education expenses.

530A accounts, also called “Trump Accounts”, are new IRAs for children under 18 with a Social Security number. Filing Form 4547 with your 2025 tax return establishes the account, and eligible U.S. citizens born between January 1, 2025, and December 31, 2028 will receive a $1,000 federal contribution to kick-start their accounts. Beginning July 4, 2026, individuals, employers, and charities may begin contributing to 530A accounts. Funds must be invested in Treasury-approved U.S. stock index mutual funds or ETFs and are generally locked until age 18, after which standard IRA rules apply, providing greater tax and withdrawal flexibility if the account remains separate from other investments.