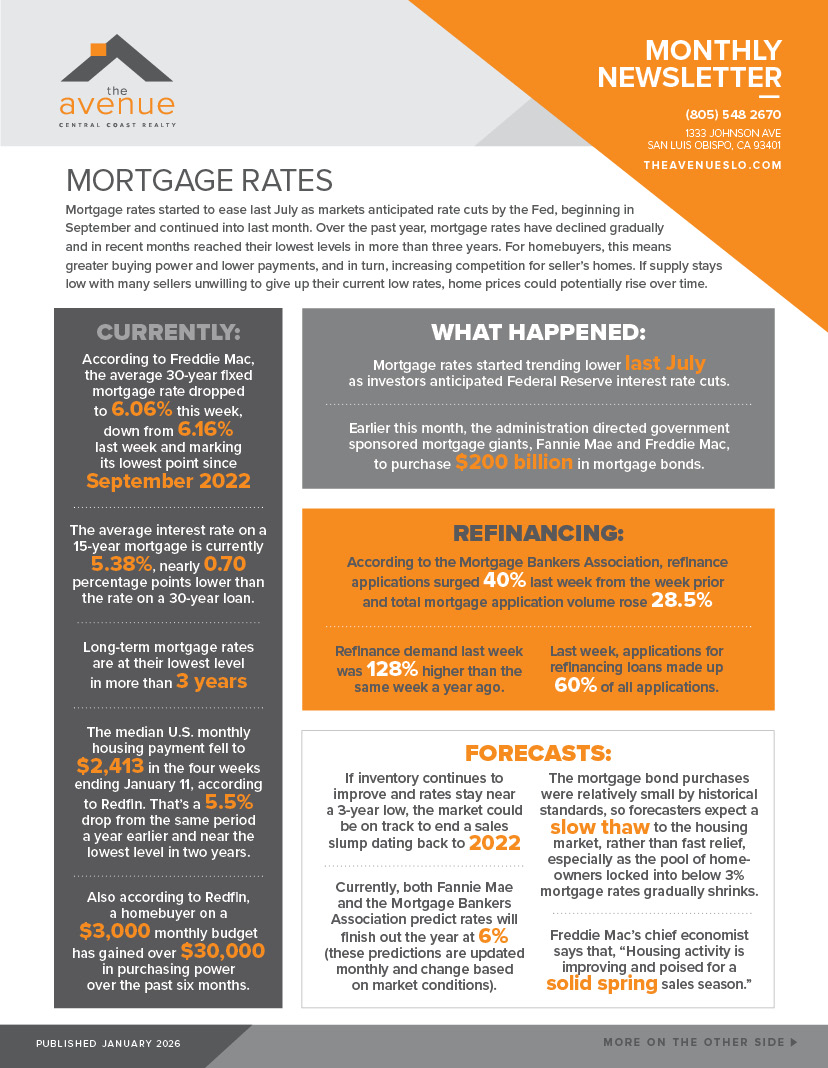

SLO County Market Update & Article on MORTGAGE RATES

*INTERESTING FACT –

January is the peak month for pup births at the Piedras Blancas Elephant Seal Rookery in San Simeon. Nearly 5,000 pups are born at this location every year.

MORTGAGE RATES

Mortgage rates started to ease last July as markets anticipated rate cuts by the Fed, beginning in September and continued into last month. Over the past year, mortgage rates have declined gradually and in recent months reached their lowest levels in more than three years. For homebuyers, this means greater buying power and lower payments, and in turn, increasing competition for seller’s homes. If supply stays low with many sellers unwilling to give up their current low rates, home prices could potentially rise over time.

CURRENTLY:

- According to Freddie Mac, the average 30-year fixed mortgage rate dropped to 6.06% this week, down from 6.16% last week and marking its lowest point since September 2022

- The average interest rate on a 15-year mortgage is currently 5.38%, nearly 0.70 percentage points lower than the rate on a 30-year loan.

- Long-term mortgage rates are at their lowest level in more than 3 years

- The median U.S. monthly housing payment fell to $2,413 in the four weeks ending January 11, according to Redfin. That’s a 5.5% drop from the same period a year earlier and near the lowest level in two years.

- Also according to Redfin, a homebuyer on a $3,000 monthly budget has gained over $30,000 in purchasing power over the past six months.

WHAT HAPPENED:

- Mortgage rates started trending lower last July as investors anticipated Federal Reserve interest rate cuts.

- Earlier this month, the administration directed government sponsored mortgage giants, Fannie Mae and Freddie Mac, to purchase $200 billion in mortgage bonds.

REFINANCING:

- According to the Mortgage Bankers Association, refinance applications surged 40% last week from the week prior and total mortgage application volume rose 28.5%

- Refinance demand last week was 128% higher than the same week a year ago.

- Last week, applications for refinancing loans made up 60% of all applications.

FORECASTS:

- If inventory continues to improve and rates stay near a 3-year low, the market could be on track to end a sales slump dating back to 2022

- Currently, both Fannie Mae and the Mortgage Bankers Association predict rates will finish out the year at 6% (these predictions are updated monthly and change based on market conditions)

- The mortgage bond purchases were relatively small by historical standards, so forecasters expect a slow thaw to the housing market, rather than fast relief, especially as the pool of homeowners locked into below 3% mortgage rates gradually shrinks.

- Freddie Mac’s chief economist says that, “Housing activity is improving and poised for a solid spring sales season.”